Chargeback Software Built for Merchants

Reduce chargebacks and friendly fraud with MidMetrics™ solutions for merchants. We can help you navigate the chargeback process, reduce fraudulent activity, streamline chargeback disputes and improve customer service all with a single solution.

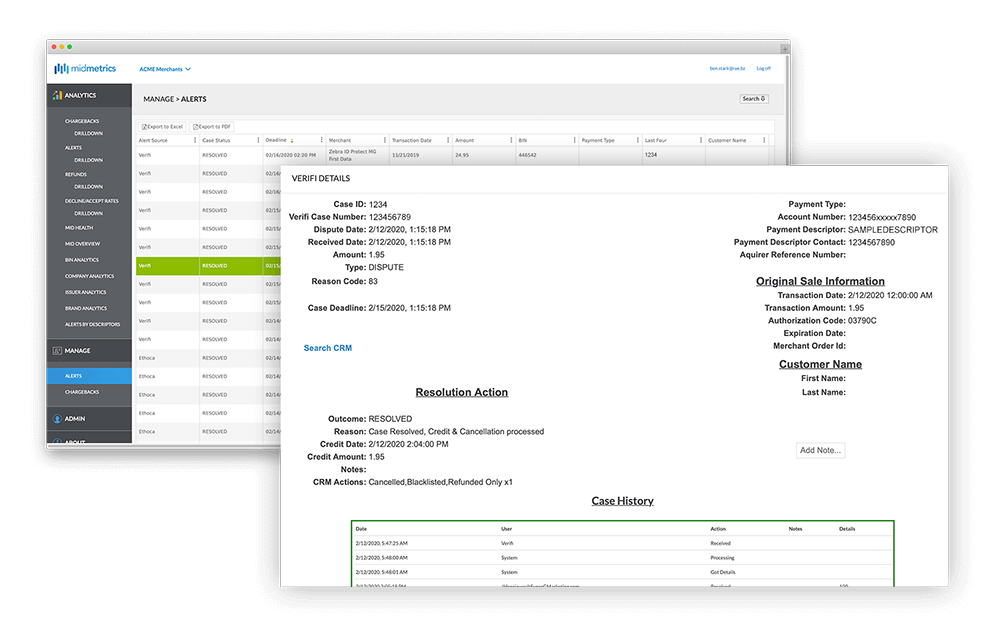

Chargeback Prevention Alerts

MidMetrics™ utilizes the largest prevention alert networks (Verifi and Ethoca) to help you prevent chargebacks before they occur.

- Alerts are received in real-time and can be emailed to clients to ensure that no credit card or debit card alert is missed.

- We offer an integrated, self-service dashboard where merchants can access, view, and manage alerts in one convenient place.

Concierge Service

We offer a turnkey solution where our staff will work within your CRM to manage alerts on your behalf using our comprehensive chargeback management tools. This includes canceling customer accounts, providing refunds on alerted transactions and any subsequent charges, and notifying alert companies of resolutions.

SOS & RECON

We can identify vulnerabilities in your merchant account ecosystem with real-time dashboards, flags, and warnings that identify potential problems.

Our merchant account reconciliation tools help identify billing discrepancies and over-reserving. Features include:

- Monitoring daily merchant account settlements and bank deposits

- Ensuring the merchant is billed correctly

- Notifying merchants if any billing discrepancy is found

- Tracking reserve funds and fees charged by processors

- Sending merchants daily report about settlement, deposits, fees, and reserves

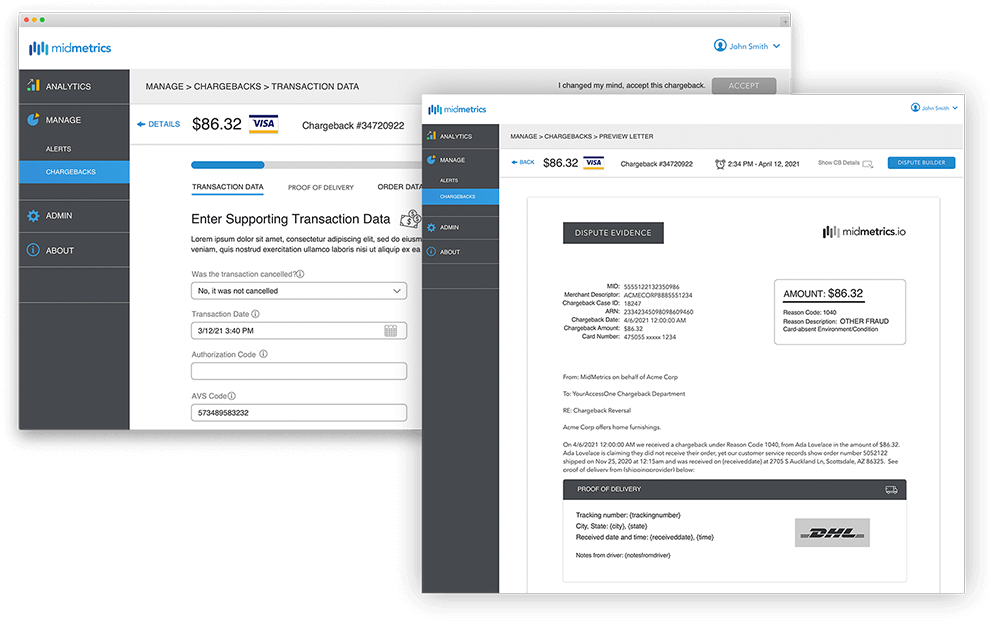

DisputeGenius™

DisputeGenius™ is our chargeback dispute representment solution. It is an essential piece of dispute management software in the chargeback process ecosystem. Unlike anything else in the market, it allows you to generate highly effective rebuttal letters, including compelling evidence, through the use of our custom, dynamically generated templates. DisputeGenius™ gives you more control over your representment process while simultaneously streamlining it. Make representments easier and more effective, save time, and recover more revenue with DisputeGenius™.

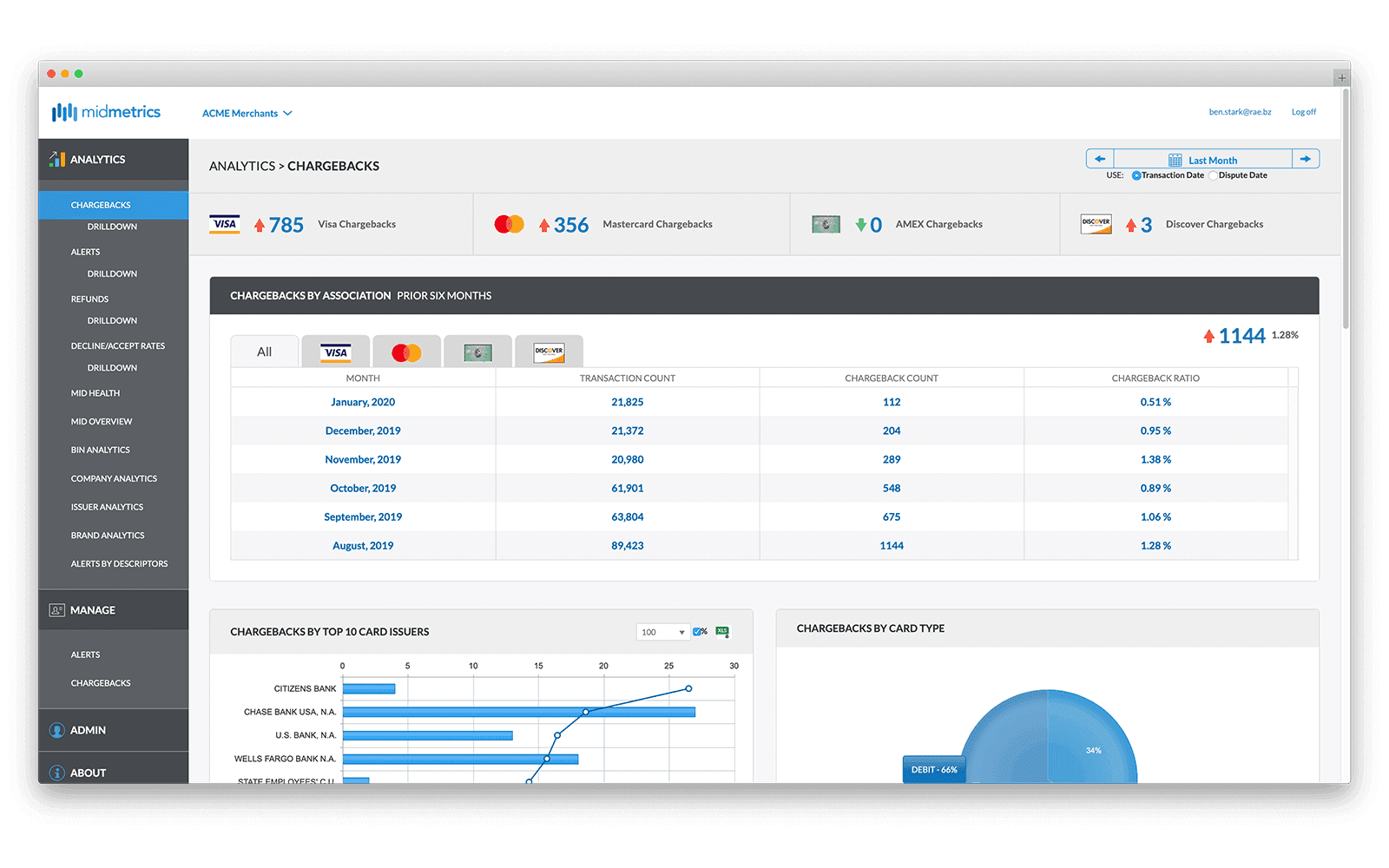

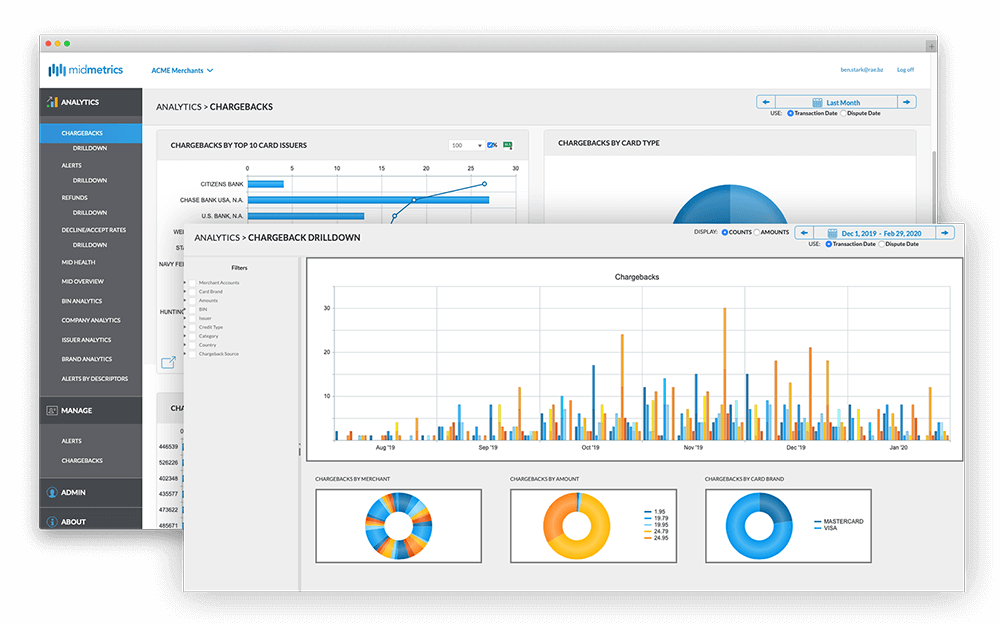

Chargeback Analytics

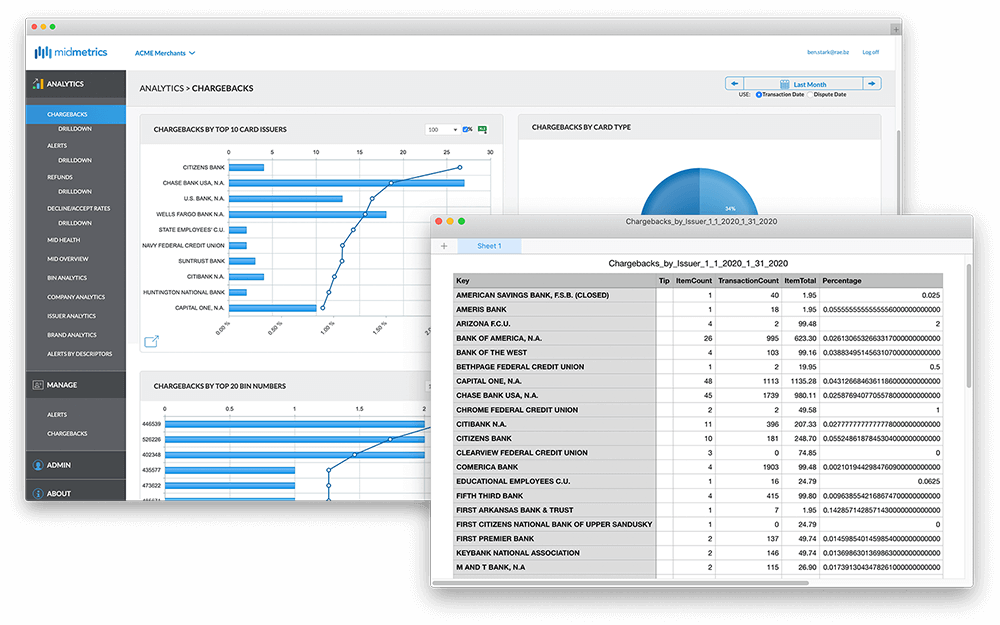

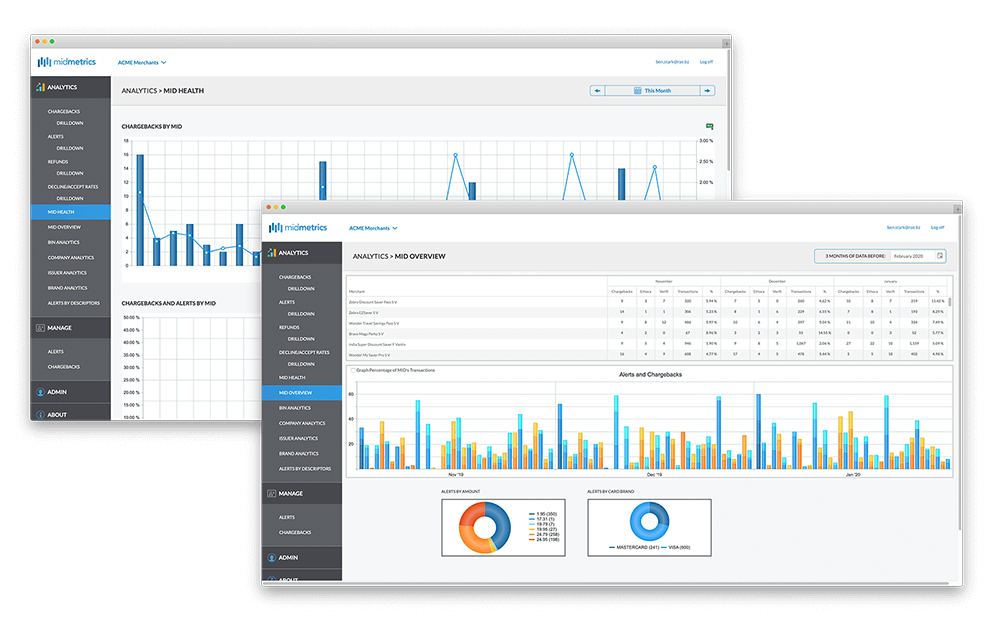

Our chargeback analytics dashboard is a unique chargeback solution that allows you to have a comprehensive view of your entire chargeback ecosystem. Among the dashboard features are:

- MID Health and Overview reports

- Numerous sorting options for chargeback data, including credit card issuer, card brand, prevention alerts, refunds by BIN, company, issuing bank, price point, date, and transaction sequence

- The ability to view your chargebacks at a broad view or to drill down into the details of individual chargebacks

Why MidMetrics™?

Drawing on more than 20 years of merchant experience, we developed a suite of chargeback protection tools fitting the needs of merchants that had been left unaddressed by existing chargeback protection providers. Using our tools, merchants can expect a significant chargeback reduction in various types of chargebacks over a 30 to 90 day period, preventing 30-40% of their fraudulent chargeback activity.